Payment Gateway Testing – How To Test + Testing Checklist

Have you ever had that heart-stopping moment when your online purchase hangs mid-transaction?

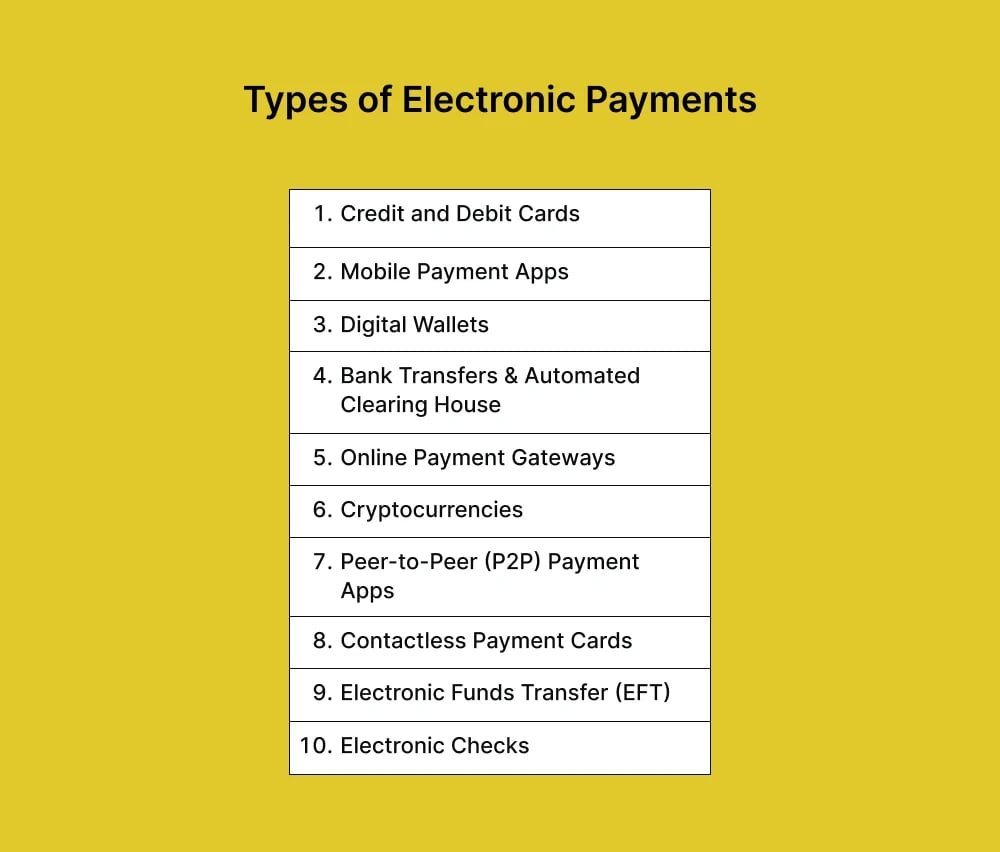

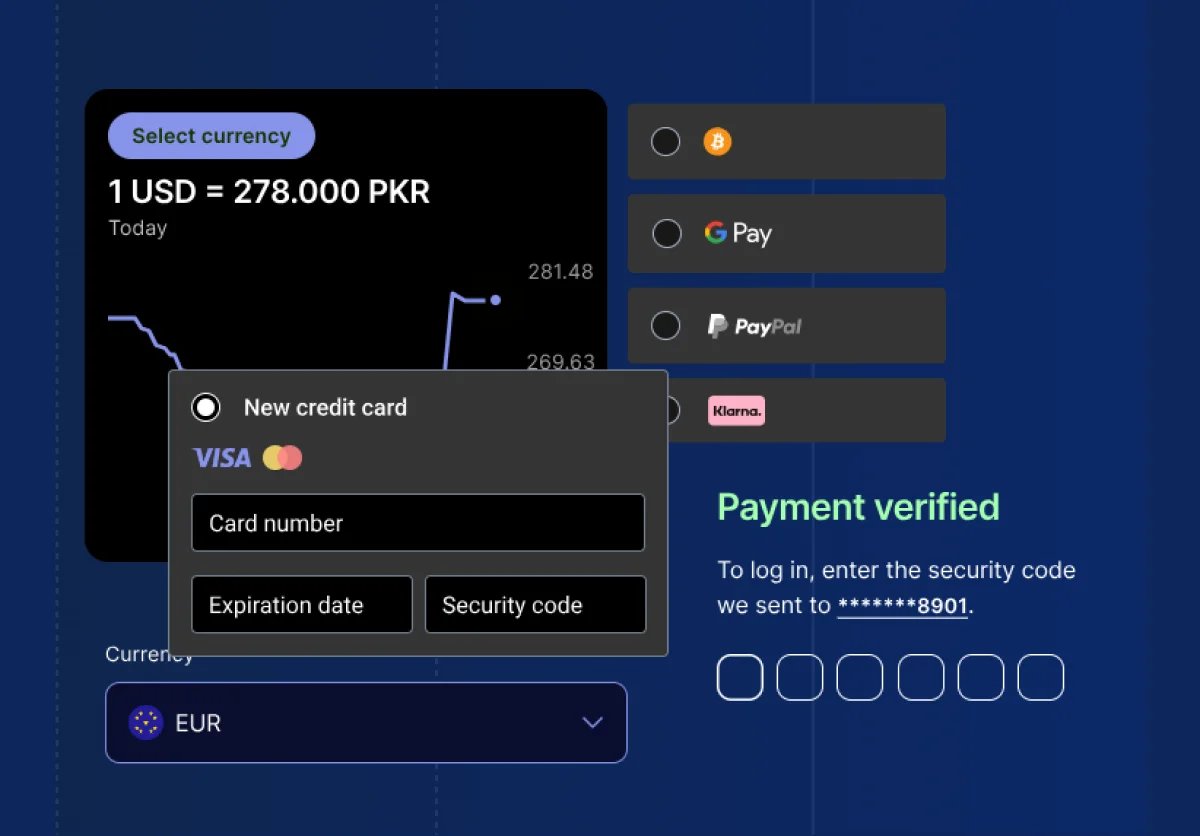

Whether you use a credit card, access your bank account, or even dabble in cryptocurrency, payment gateway testing ensures that your transaction is processed swiftly and securely.

For customers, this means peace of mind and a streamlined experience. And for e-commerce companies, it's all about keeping their operations running smoothly and their customers satisfied.

In this in-depth guide, we'll cover the following:

- What is a payment gateway

- What is payment gateway testing

- Importance of gateway testing and a handy checklist

And to learn more about how to write payment gateway use cases, check out this post for practical examples.

We can help you drive payment gateway testing as a key initiative aligned to your business goals

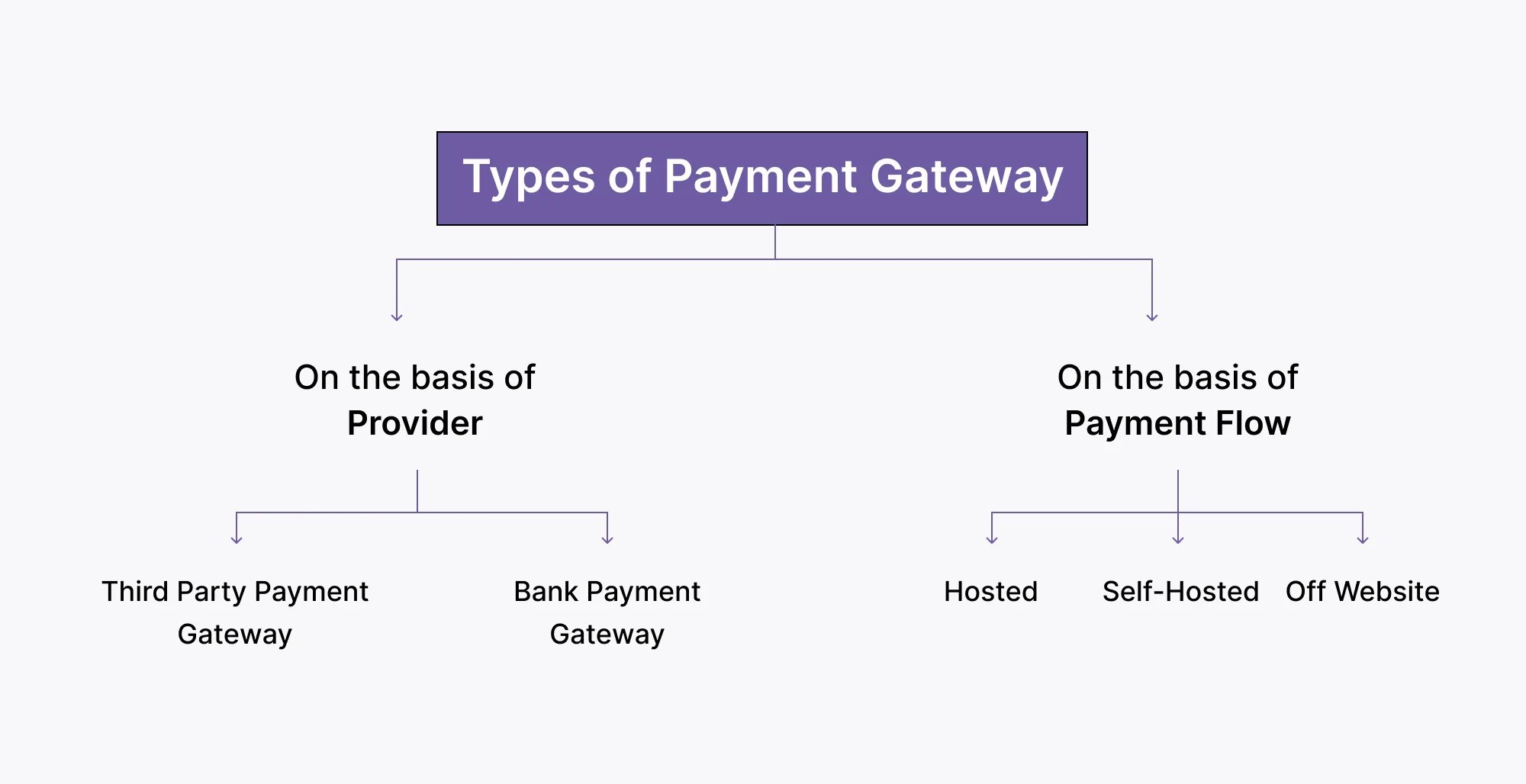

What is a payment gateway?

First, let's start with the basics. The payment gateway is a middleman between customers and businesses, helping online stores accept payments securely. Its primary purpose is to enable online businesses to receive payments smoothly.

Advantages of payment gateways

Global reach:

- Enables transactions from anywhere in the world and in multiple currencies.

- Expand business opportunities and offer diverse payment options to customers.

Cost reduction:

- Cost-efficient automated processes compared to traditional methods.

- Minimal transaction costs and no hidden expenses.

Customer convenience:

- Enhance the shopping experience with instant, hassle-free payments from anywhere.

- Optimize purchase processes for maximum customer satisfaction.

Acceptance of multiple payment options:

- Support a variety of payment methods, including credit cards, debit cards, and e-wallets.

- Adapt to emerging trends like UPI, crypto payments, and mobile wallets.

Error reduction:

- Automate payment processes to minimize human errors.

- Ensure accurate transaction calculations and seamless integration with shopping carts.

What is payment gateway testing?

As we established, a payment gateway has numerous benefits for both e-commerce owners and customers. But to ensure everything runs as a clock, you must test it before going live.

Payment gateway testing involves a comprehensive examination of every aspect of a payment system or application to guarantee its functionality, security, and compliance. This testing covers various components, such as payment gateways, processors, and methods, and validating transaction processes from initiation to completion.

Importance of payment gateway testing

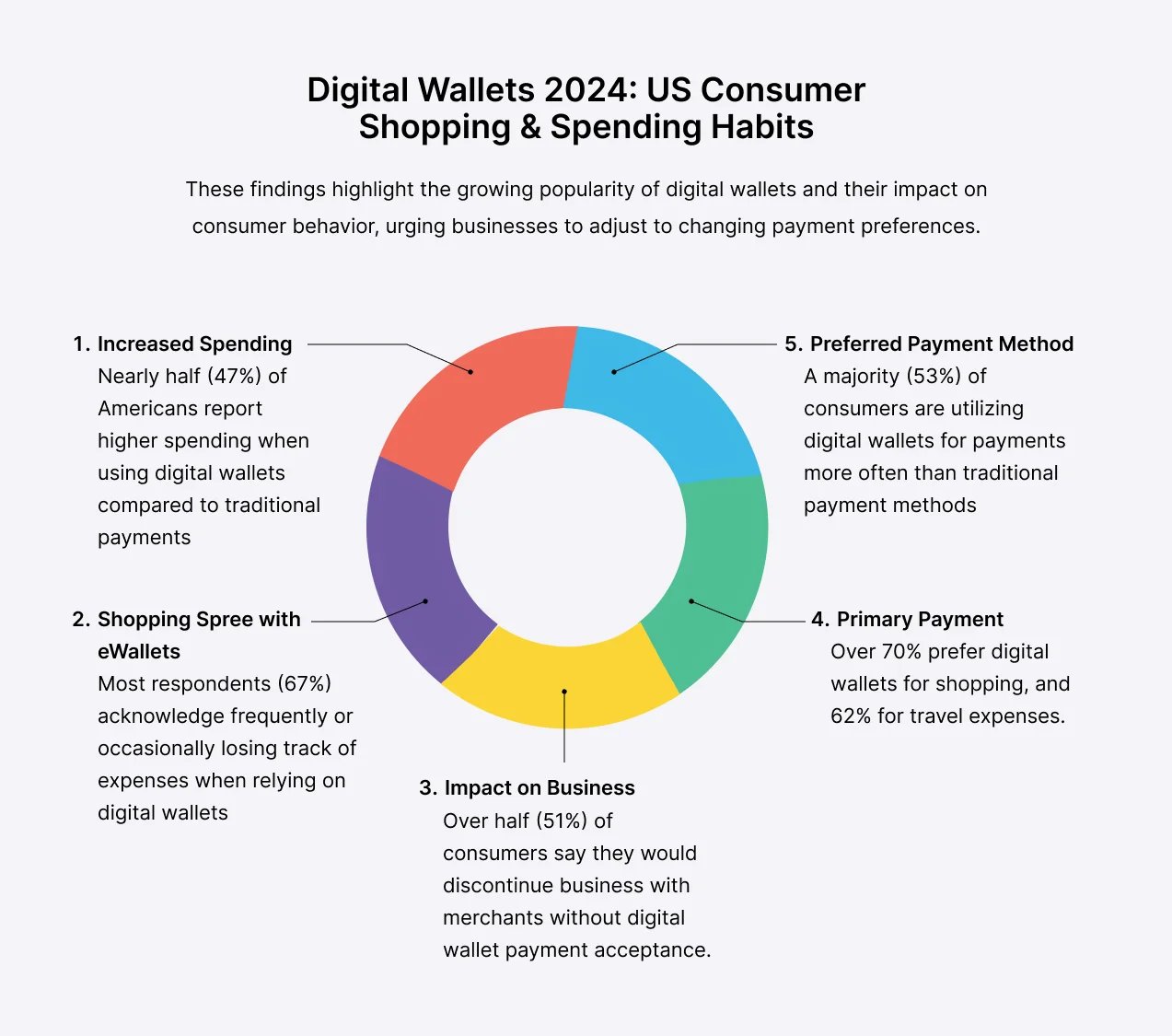

In the last five to ten years, advancements in internet technology and the rise of e-commerce and online payments have elevated digital payment methods to the norm.

Still, choosing which one to offer is challenging due to its global diversity and the emergence of new methods. For instance, while credit cards like American Express, Mastercard, and Visa are widely recognized globally, other methods are more prevalent in specific regions:

- In Asia-Pacific (APAC), digital payment adoption is pronounced, with services like Alipay and WeChat Pay dominating the market.

- Europe offers various online payment methods, from Stripe and Klarna to Bancontact.

- Latin America (LATAM) experiences significant growth in electronic payments, with methods like PIX in Brazil and Boleto Bancário gaining traction.

- The Middle East favors card-based payment methods such as BENEFIT in Bahrain and KNET in Kuwait.

- North America continues to see the popularity of cards, but alternative methods like digital wallets (e.g., Apple Pay, PayPal) and Buy Now Pay Later options (e.g., Cash App) are on the rise.

Pro tip

If you want to provide seamless payment experiences and optimize conversion rates, you should understand regional preferences and offer diverse popular online payment methods.

At Global App Testing, we specialize in providing comprehensive QA solutions that meet businesses' evolving needs worldwide.

Our services extend beyond traditional testing methodologies, as we offer services that ensure the functionality, security, and compliance of your products and services. Here's how we can assist you:

We navigate complex stacks and integrated systems, verifying the entire customer journey:

- This includes elements like virtual cards, bank app confirmations, and fingerprint authentication, which comprehensively address identity and legal test requirements.

We mitigate risks associated with fraud, security, and legal compliance:

- By employing real-identity testers and enabling actual cash movements, reinforced by our ISO 27001 certification.

Our expansive reach spans 190+ countries and accommodates diverse device mixes:

- Enabling comprehensive testing of money movement across borders and platforms, improving checkout performance for ecommerce businesses.

Our expertise extends beyond functional testing:

- We ensure optimal user experiences across different markets with localization testing and UX reviews.

- We specialize in assisting businesses in maintaining updated competitor information, particularly regarding local Know Your Customer (KYC) requirements.

What are the benefits of payment gateway testing

1. Scalability and performance

Payment gateway testing ensures the system can handle varying transaction volumes without compromising performance. This scalability is vital for smooth and efficient payment processing, especially during peak periods such as sales events or holidays.

2. Compatibility and integration

Testing ensures seamless integration with various platforms, devices, and third-party services. This compatibility provides a consistent payment experience across different channels and ensures interoperability with other systems used by the business.

3. Data integrity and privacy

Payment gateway testing verifies that sensitive payment data is handled securely and complies with privacy regulations such as GDPR or CCPA. It ensures customer information remains confidential and protected from unauthorized access or data breaches.

4. Continuous improvement

Testing is not a one-time activity but an ongoing process to identify and address emerging threats, evolving regulations, and changing user expectations. Regular testing helps businesses stay ahead of the curve and continuously improve their payment systems to meet customers' needs.

How to perform payment gateway testing

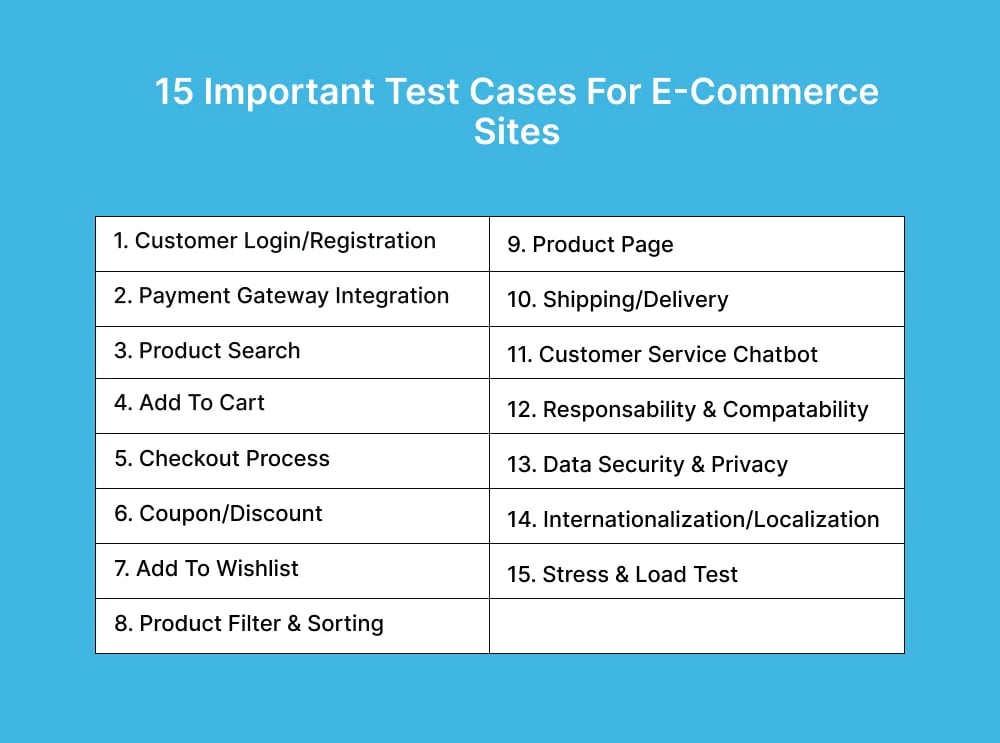

Different types of testing are necessary depending on the chosen payment processor and the requirements of the product or application:

- Functional Testing: This type of testing is essential for newer or less established payment gateways to ensure that the application functions correctly and handles orders, calculations, taxes, and other aspects precisely as intended. Established payment processors may not require this level of testing.

- Integration Testing: Testers need to verify that the website, online store, or application integration works seamlessly with the selected payment gateways. They should verify the entire transaction flow, including placing orders, confirming receipt of funds in the merchant account, and successfully processing refunds or voids.

- Performance Testing: It's vital to assess the website, online store, or application's performance, particularly the payment processor's capabilities. The system should remain stable and responsive even when multiple users attempt transactions simultaneously.

- Security Testing: Customers provide sensitive information like credit card numbers and CVV numbers during transactions, so security testing ensures that all sensitive data is encrypted during transmission and that the communication channel remains secure.

Payment gateway checklist

Testing payment gateways requires careful planning and execution. Below is a checklist that you can use as a reference:

☐ Set up a payment processor sandbox environment for testing purposes.

☐ Obtain test credit card numbers to simulate transactions with different card types.

☐ Verify the application's response when a transaction is successful.

☐ Ensure that the payment gateway is redirected to the application after a successful transaction and that it displays a confirmation message.

☐ Confirm that customers receive transaction confirmation notifications, such as order confirmation emails, following a successful transaction.

☐ Test the application's response to payment failures or unresponsive payment processors.

☐ Verify that appropriate error messages are displayed.

☐ Assess how the application behaves with browser popup blockers enabled or disabled, particularly regarding confirmation messages displayed in popups.

☐ Test various fraud prevention and security settings. For instance, ensure that transactions are declined if the billing information doesn't match the address provided to the issuing bank.

☐ If database access is available, verify transaction entries in the database.

☐ Check how the application handles expired customer sessions during transactions.

☐ Monitor the console for any errors throughout the transaction process and report any observed errors.

☐ Ensure transactions occur over a secure channel, such as HTTPS for checkout pages versus HTTP for other website pages.

☐ Verify that the payment processor is configured to accept the correct currency based on the application's geographic location or business type.

☐ If the application offers multiple payment options (e.g., credit card and PayPal), test each option individually from start to finish.

☐ Confirm that refund or void amounts initiated from the payment processor's admin portal match the transaction amount. Refund or void amounts should never exceed the original transaction amount.

Payment gateway test case example: Credit card payment processing

Objective: To verify the functionality of the newly integrated payment gateway by successfully processing a credit card payment.

Preconditions:

- The e-commerce platform is accessible and functional.

- The new payment gateway is integrated into the platform.

- Valid test credit card details are available for testing purposes.

Test steps:

- Navigate to the checkout page of the e-commerce platform.

- Select the credit card payment option.

- Enter valid credit card details, including card number, expiration date, CVV, and cardholder name.

- Initiate the transaction by clicking the "Pay Now" or equivalent button.

- Verify that the payment gateway processes the transaction.

- Confirm the payment processing status.

- Check for the generation of a confirmation email regarding the successful transaction.

Expected result:

- The transaction is processed successfully without errors.

- A confirmation email is received, confirming the payment.

- The payment gateway functions smoothly, accommodating various credit card options.

Pass criteria:

- The transaction is completed without any errors or interruptions.

- The confirmation email is received within a reasonable time frame.

- The payment gateway handles different credit card options effectively.

Fail criteria:

- The transaction encounters errors or fails to process.

- No confirmation email is received after initiating the transaction.

- The payment gateway does not support or accommodate various credit card options.

Note: Ensure to use valid test credit card details for testing purposes to simulate a real transaction scenario.

Wrapping it up

Combining manual and automated testing is an effective strategy for payment gateway testing. While automation is efficient for repetitive tasks and complex scenarios, manual testing provides subjective insights into user experience and real-world payment methods.

Automated testing easily handles repetitive tests and complex scenarios, such as time-outs and data corruption. However, manual testing remains crucial for evaluating the user experience and assessing the smoothness and friendliness of the payment process. Additionally, manual testers can use real payment methods, offering insights into user paths relevant to their location.

How can Global App Testing assist you?

With over 90,0000 real testers in 190+ countries, we offer user testing, virtual card simulations, global coverage, and compliance-focused assessments that can be tailored to your needs. Our testing includes:

- Usability testing: Assessing user experience across different devices and platforms to ensure seamless functionality.

- Accessibility testing: Verifying compatibility with assistive technologies to ensure accessibility for users with disabilities or impairments.

- Functional testing: Testing essential functions across any browser or operating system.

- Regression testing: Ensuring that new changes or updates do not negatively impact product stability over time.

- Localization testing: Evaluating app performance for diverse international markets to ensure local relevance and compliance.

- Compatibility testing: Testing across various browsers, devices, operating systems, and network configurations to guarantee optimal performance across all platforms.

Are you interested to learn more?

Call our specialist today to see how we can enhance your payment gateway testing strategy!

We can help you drive payment gateway testing as a key initiative aligned to your business goals

FAQ

What’s the difference between a payment gateway and a payment processor?

The payment gateway securely transmits online payment data to the processor to continue transactions, mainly for eCommerce sites. It acts as an online point-of-sale terminal. In contrast, the payment processor manages transaction processing, including authorization and fund capture.

What are the key components of payment gateway testing?

Key components include functional testing (ensuring the gateway functions as expected), security testing (assessing data protection measures), and compliance testing (verifying adherence to industry regulations).

What are common challenges in payment gateway testing?

Challenges may include handling diverse payment methods, ensuring compatibility across devices and platforms, and addressing complex regulatory requirements.

What are the benefits of outsourcing payment gateway testing?

Outsourcing testing to specialized companies, like Global App Testing, can provide access to skilled testers, diverse testing environments, and cost-effective solutions. This ensures comprehensive testing coverage and quicker time to market.

Keep learning

QA vs. Software testing - What's the difference?

6 iOS testing frameworks to use

Android mobile app testing checklist