12 Payment Gateway Testing Interview Questions

The best way to ace a payment gateway testing interview is to come well-prepared. To achieve that, you need to know the answers to various questions, such as the best payment gateway testing practices, whether you understand regulatory standards, and how to handle failed transactions or disputes. In this text, we will answer those questions in detail and try to prepare you for the interview as well as possible. Let's begin!

Join our community of 70,000+ testers around the globe and earn money testing websites and apps in your free time.

Why do you need to test payment gateways?

When managing an online business, payment gateway testing is a key component that is often overlooked. Testing payment gateways is conducted to ensure the system's security and reliability and identify potential issues or bugs before they cause serious problems.

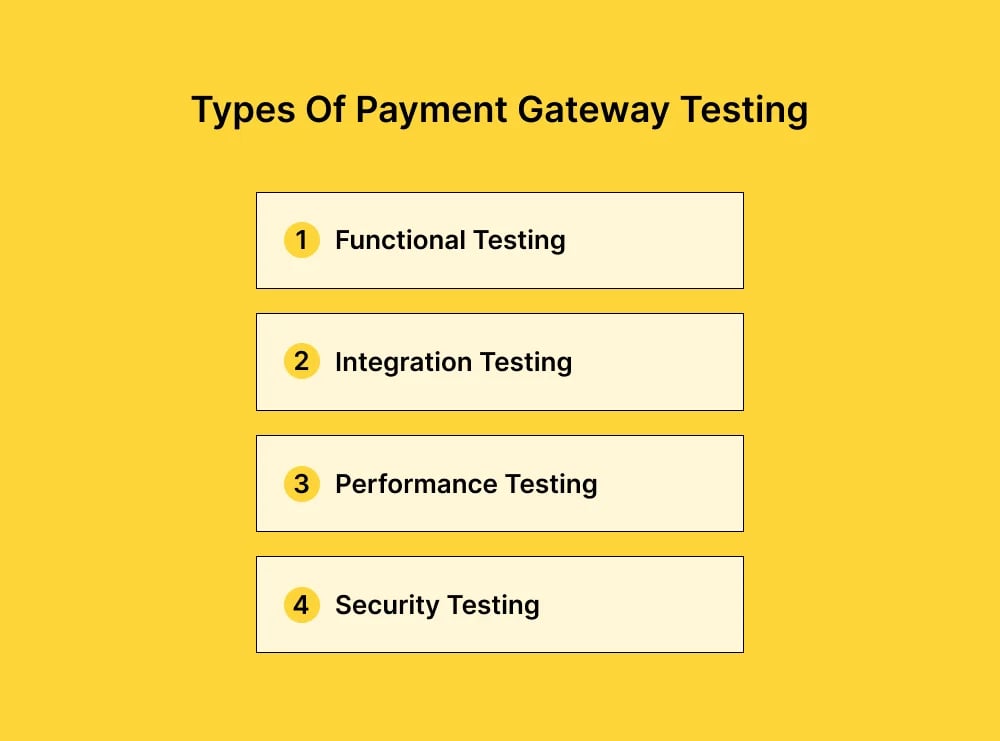

Payment gateway testing types

Payment gateway testing involves various types of testing to ensure that it functions properly and securely:

- Functional testing ensures that the payment gateway performs all the necessary functions correctly. It involves testing individual features like payment processing, refunds, and cancellations.

- Integration testing verifies the payment gateway correctly integrates with the e-commerce platform or website. It includes testing the communication and data flow between the payment gateway and third-party APIs.

- Performance testing involves testing the payment gateway's response times and ability to handle large transaction volumes. This ensures that the gateway can handle high traffic without becoming slow or crashing.

- Security testing ensures that the payment gateway is secure from unauthorized access and attacks. It involves testing for vulnerabilities like SQL injection or cross-site scripting attacks and verifying that the payment gateway is PCI DSS compliant.

12 Payment gateway testing interview questions

Preparing for a payment gateway testing interview requires a solid understanding of key concepts and practices. Here's a comprehensive overview of key questions to help you ace your interview and demonstrate your expertise in this field.

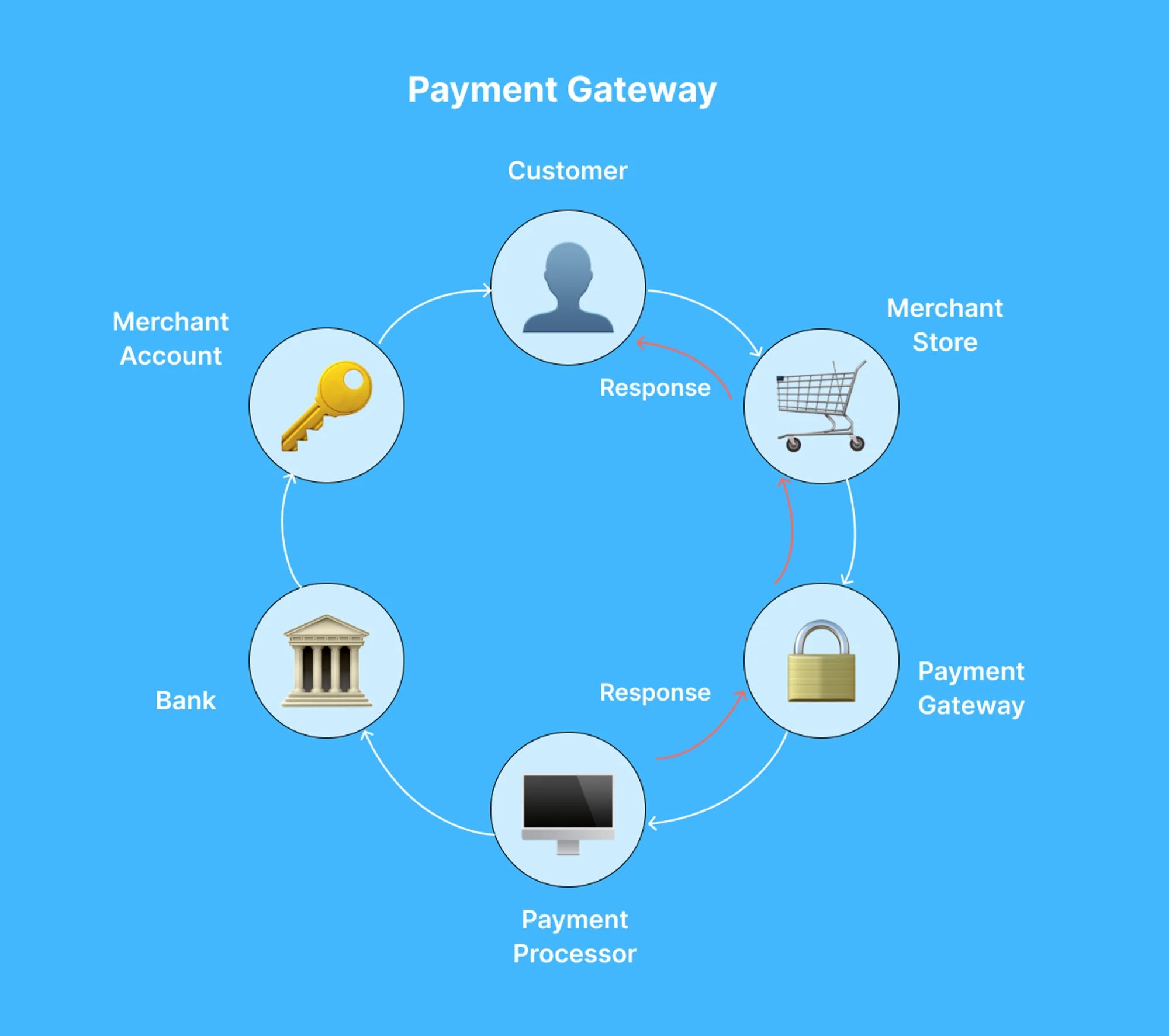

1. Could you clarify what a payment gateway is and how it works?

Sure! When we talk about online payments, the payment gateway is a service that mediates between the merchant and the customer's bank, ensuring that transactions are processed securely and accurately. The functioning of a payment gateway generally involves the following steps:

- Payment data encryption: When a customer submits their payment information, the data is encrypted to prevent unauthorized access.

- Authorization: The payment gateway then checks if the submitted payment data satisfies all regulations and standards, including fraud screening, address verification, and validation of the payment method.

- Payment processing: If the payment is authorized, it is processed, and funds are transferred from the customer's account to the merchant's.

- Transaction reporting: Finally, the payment gateway generates transaction information for both the customer and the merchant, allowing for account reconciliation.

2. Could you explain how you would design and implement a secure payment system?

When designing and implementing a secure payment system, I focus on several key steps:

- Research payment gateway options: First, I would research different payment gateway options to determine which would best fit the project's needs.

- Plan payment flow: I would then plan out the payment flow for the project, including all steps involved, from when the customer chooses to make a payment to when the payment is verified and processed.

- Implement security measures: Next, I would implement necessary security measures, including SSL encryption, PCI compliance, and two-factor authentication. This would ensure that sensitive data, such as customer payment information, is kept secure.

- Test payment system: Once the payment system is implemented, I would perform thorough testing to identify any potential vulnerabilities or bugs.

- Monitor and update the system regularly: Finally, I would monitor the payment system for security threats and updates, ensuring it remains secure over time.

3. What is your experience with implementing payment gateways?

In my career, I've integrated payment gateways across various projects, ensuring secure and efficient transaction processing. For instance, in an e-commerce platform, I integrated payment gateways like PayPal, Stripe, and Authorize.Net to provide users with diverse payment options.

- Before implementation, I thoroughly researched industry standards and guidelines to ensure compliance and security.

- I used frameworks like Stripe API or PayPal SDK. I developed various transaction flows, safeguarding sensitive user data with encryption protocols.

- Additionally, I optimized checkout processes to improve user experience, leading to increased conversion rates and customer satisfaction.

4. How do you make sure payment data handling follows industry rules like PCI-DSS and GDPR?

By following these measures, I managed to ensure that payment processes follow industry rules:

- Use SSL encryption to secure payment data transmissions.

- Implement two-factor authentication to verify user identities.

- Build the system to comply with industry-recognized standards.

- Regularly perform risk assessments of the system's security vulnerabilities.

- Train employees on security awareness and proper data handling procedures.

5. How can payment gateways manage high transaction volumes?

The best way to manage a high volume of transactions is by:

- Optimizing infrastructure, including servers, databases, and network bandwidth, improves performance and scalability.

- We can employ load-balancing techniques, such as distributing traffic across multiple servers or data centers.

- We are implementing automatic transaction retry mechanisms. They can reduce the rate of transaction failures due to errors or system issues.

- We are adopting real-time monitoring and alerts. They can help identify and address issues in real time, reducing downtime and increasing the reliability of the payment gateway.

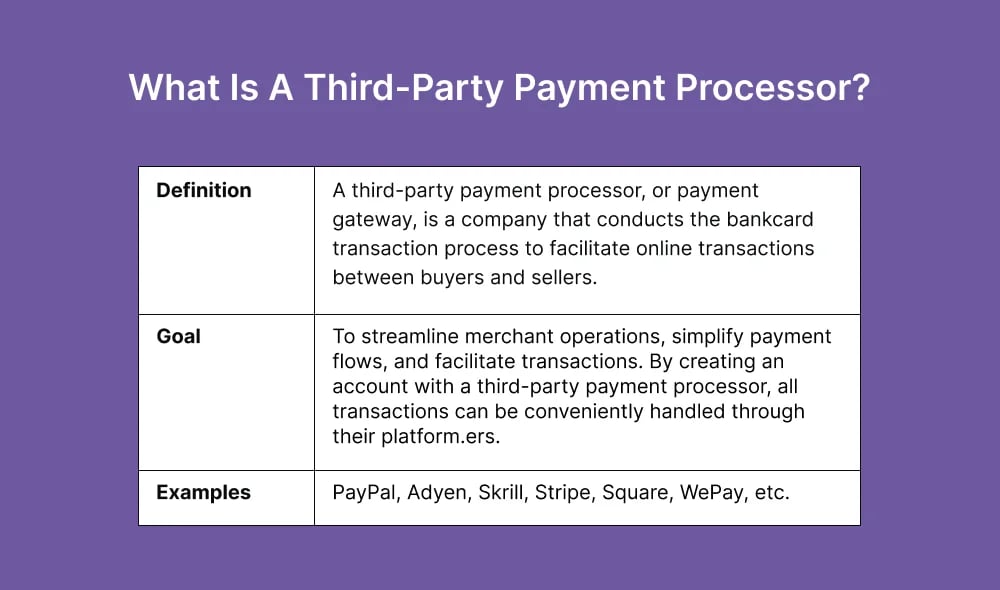

6. Could you describe your experience with integrating third-party payment processors like Stripe, PayPal, Google Pay, or Apple Pay?

Regarding integration of third-party payment processors, my experience involves:

- Researching the payment provider documentation to identify APIs, tools, and resources needed for integration.

- Create a sandbox account and run multiple test scenarios to ensure proper functionality.

- Developing code modules to handle the payment process, validate user input, and display payment confirmation messages.

- Troubleshooting and debugging issues, such as error messages related to integration.

- Updating the codebase to account for changes in the Payment Provider APIs.

7. Could you provide an instance of a problematic issue encountered while implementing a payment system and how you resolved it?

While implementing a payment system for a client, I faced difficulties with credit card validation, which resulted in failed transactions and payment issues. To resolve the problem, I took the following steps:

- We consulted with the payment gateway provider to identify the cause of the issue.

- We created additional validation checks and bank-specific card support based on feedback.

- Performed thorough testing to ensure the solution was effective.

8. What best practices do you follow when testing payment systems to guarantee reliability, security, and user-friendliness?

In my experience, these are the best practices that I usually follow:

- Test all payment features and functions: Conducting testing will ensure that all payment-related features and functions are working correctly and that users can complete a transaction successfully.

- Implement security measures: Encryption, firewalls, and other security measures should be implemented to protect sensitive information and prevent unauthorized access to user data.

- Simulate different payment scenarios: By simulating different payment scenarios, potential problems can be identified and addressed before they occur in real-world transactions.

- Utilize multi-factor authentication: Multi-factor authentication adds an extra layer of security to prevent unauthorized access to user accounts or payment information.

- Ensure compliance with industry standards: Compliance with industry standards, such as PCI DSS, ensures that payment systems are secure and meet the requirements.

9. Have you supported payment methods like one-time purchases, subscriptions, and freemium models?

Yes, I have solid experience supporting various payment methods. Here are some examples of what I’ve done:

- Researched payment methods to determine which best fit the project's objectives.

- Implemented one-time purchases and fixed-price subscriptions with multi-currency support.

- Produced custom solutions such as freemium models, which involve offering users basic functionality for free and charging for premium features.

- Integrated payment methods like PayPal, Stripe, Google Pay, and Apple Pay.

- Built a system to handle automatic subscription renewals with email alerts and account settings to manage payments.

- Developed metrics to track pricing strategies' conversion rates and revenue.

10. How do you manage situations like unsuccessful transactions or payment disputes?

The best way to manage unsuccessful transactions and payment disputes requires the following measures:

- I prioritize proactive transaction monitoring to detect issues early. This involves setting up alerts for suspicious activity, tracking payment trends, and monitoring customer feedback.

- Establish a clear process to follow so employees know the steps.

- Encourage communication with customers to understand the root cause of the issue and clarify their concerns.

- Perform a thorough transaction or payment history review to identify any errors or discrepancies.

- Provide timely and accurate responses addressing the customer's concerns or questions.

- Work with third-party payment processors or banks to resolve any underlying issues.

11. What is your expertise in fraud management within payment gateways?

In my experience, the best way to prevent fraud is by using these methods:

- Utilizing fraud detection tools: Payment gateways should implement intelligent fraud detection tools, such as machine learning algorithms or manual review processes, to detect and prevent potentially fraudulent transactions.

- Developing a response plan: Having a predetermined plan for responding to suspected fraud, including notification processes and escalation procedures, can help reduce the impact of fraudulent activity.

- Staying up to date on fraud trends: Staying informed on the latest fraud trends and tactics to quickly identify new threats and implement appropriate measures to prevent them.

- Implementing risk management strategies: Limiting transaction amounts or requiring additional verification for high-risk transactions showed good results in preventing fraud within payment systems.

12. What strategies have you employed to make the payment process faster or improve user experience?

To improve the overall payment experience, I have employed the following strategies:

- Implement One-Click Payment functionality so that users can complete transactions quickly.

- Use Apple Pay and Google Pay to simplify checkout.

- Enable Autofill features for payment and shipping information.

- Provide clear and concise instructions and feedback during the checkout process.

- Incorporate user-friendly interfaces to navigate the payment process, making it easier for users to complete transactions.

How can Global App Testing assist in testing payment gateways?

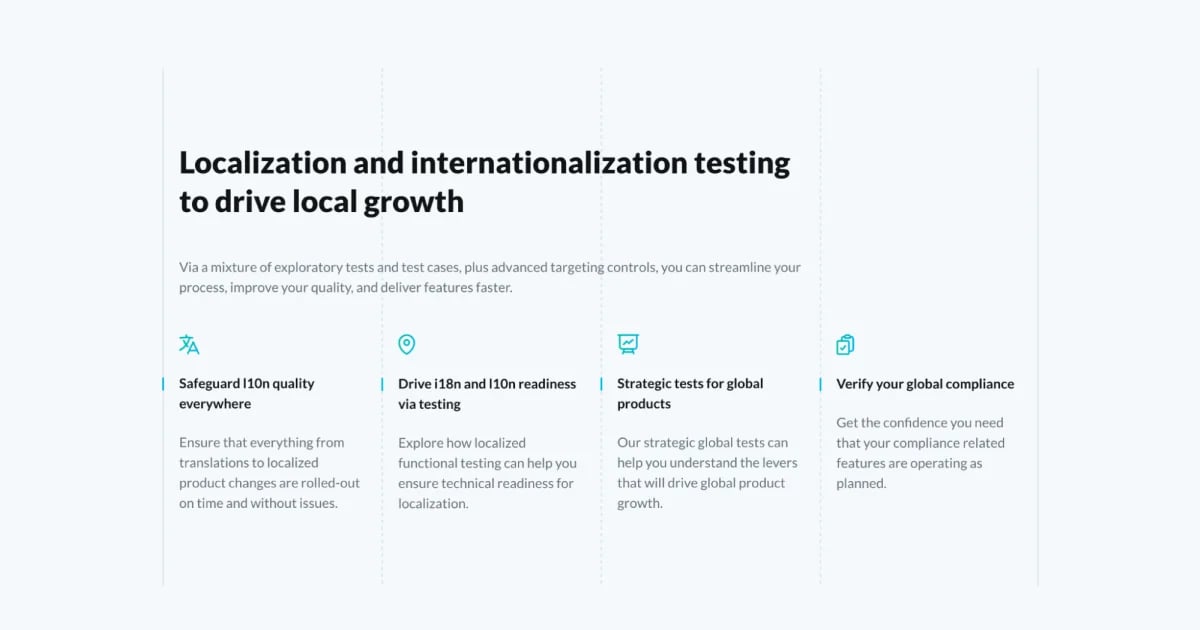

Payment gateway testing can be beneficial, particularly when you expect a reliable payment process within your product. Exploring various testing methods such as manual testing, crowd testing, or a hybrid approach can help optimize payment gateway testing strategies to suit your specific needs. Global App Testing can assist app developers and businesses in payment gateway testing by providing the following:

- Crowdsourced testing: Our global community of professional testers ensures comprehensive payment gateway testing across various devices, platforms, and locations for real-world conditions.

- Localization testing: We use testers worldwide to verify payment gateway functionality, usability, and linguistic accuracy across different regions and languages.

- Multiple real-device options: We cover smartphones, tablets, and other devices with different operating systems and versions to identify compatibility issues for a consistent, error-free payment experience.

- Regression testing: Conducting thorough tests to maintain payment gateway stability and reliability over time.

- Performance testing: Evaluating payment gateway performance under various conditions to identify bottlenecks and ensure optimal performance.

If you want to learn more about our payment gateway testing services, schedule a call with our QA specialist today!

We can help you drive payment gateway testing as a key initiative aligned to your business goals

FAQ

What are the risks of not performing proper payment gateway testing?

Not performing proper payment gateway testing can lead to security vulnerabilities, inaccurate data processing, errors in transaction processing, and poor user experience, all of which can significantly impact customer trust and may lead to financial loss.

What are the challenges of payment gateway testing?

Some challenges of payment gateway testing may include testing with multiple payment types and methods, ensuring compliance with regulatory standards, testing for various geographical locations and time zones, and ensuring compatibility with different devices, operating systems, and browsers.

What steps can be taken to prevent transaction failure during payment gateway testing?

Steps that can be taken to prevent transaction failure during payment gateway testing include testing with simulated payments, testing with different payment providers, and utilizing mock payment gateways.

Keep learning

What is payment gateway testing? Everything to know

Payment gateway test cases - A definitive guide

QA vs. Software testing - What's the difference?